PATRICIA [PINTO] MORTGAGE

SHERWOOD MORTGAGE GROUP INC. #12176

First Time Home Buyer

The Ultimate Guide for First-Time Home Buyers in Ontario

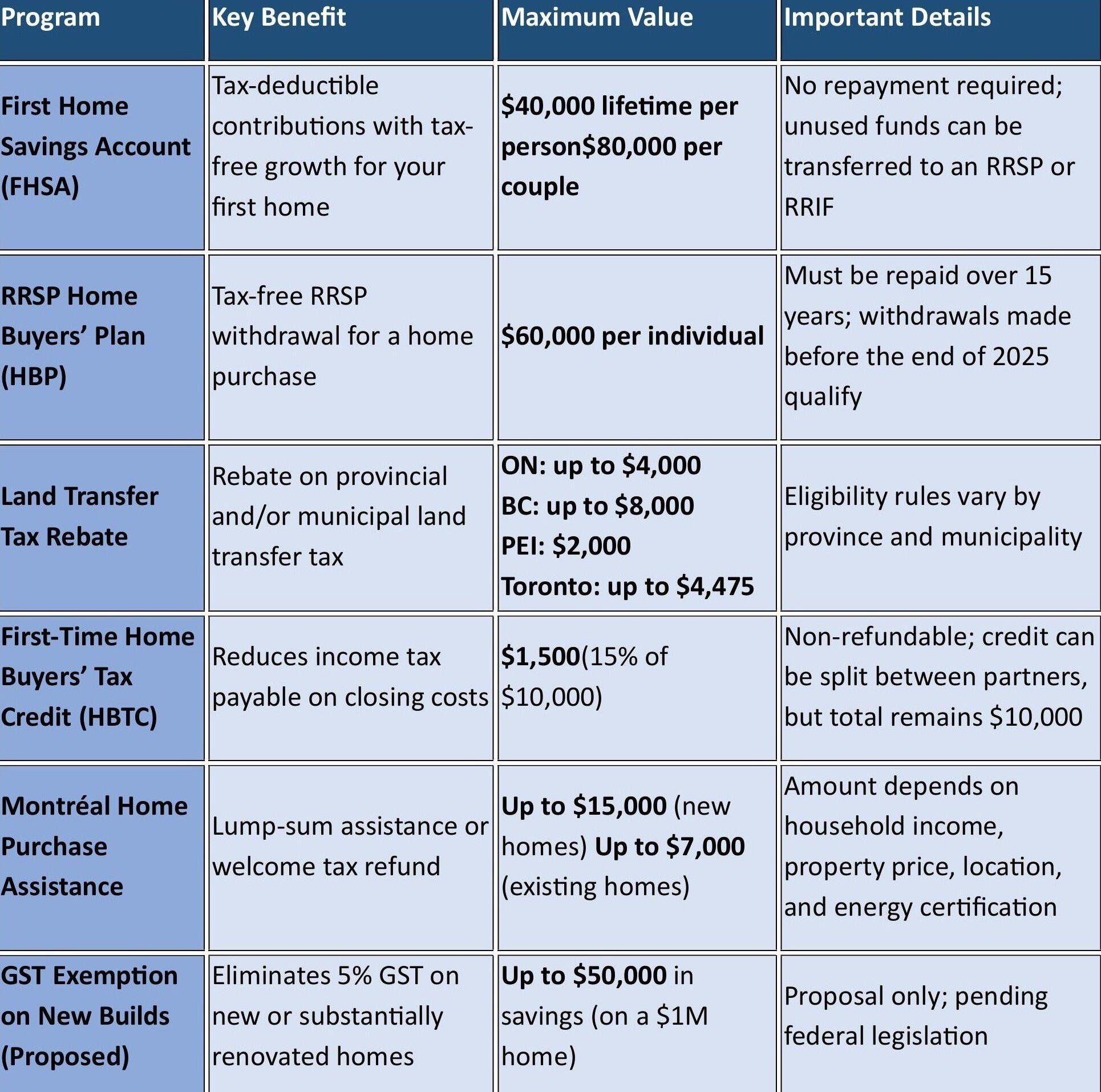

Buying your first home is one of the most exciting — and stressful — financial decisions you’ll make. Between saving for a down payment, figuring out closing costs, and navigating government incentives, it can feel overwhelming. That’s why we’ve put together this easy-to-follow guide to help first-time home buyers in Ontario make smart decisions and take advantage of every incentive available.

Who qualifies as a first-time home buyer in Ontario?

If you’re wondering whether you count as a first-time home buyer in Ontario, here’s what you need to know. To qualify—and to be eligible for the provincial and Toronto land transfer tax rebates—you must meet all of the following criteria:

- Be at least 18 years old

- Be a Canadian citizen or permanent resident

- Live in the home as your primary residence within 9 months of the transfer date

- Never have owned a home before, anywhere in the world, whether fully or partially

- If you’re married, your spouse must also never have owned a home, anywhere in the world, in whole or in partIf all of the above apply to you, you’re considered a first-time home buyer in Ontario.

Land Transfer Tax in Ontario: What Home Buyers Need to Know

Who Pays Land Transfer Tax in Ontario?In Ontario, land transfer tax is paid by the buyer, not the seller, when purchasing real estate or acquiring a beneficial interest in land — including houses, condos, and certain leasehold interests.If you’re buying a property within the City of Toronto, you’ll pay two land transfer taxes:The Ontario (provincial) Land Transfer TaxThe Toronto Municipal Land Transfer TaxThis can significantly increase closing costs, which is why planning ahead is essential.

Down Payment Calculator

Mi aliquet odio leo blandit phasellus nec est magnis cursus elementum. Sagittis pharetra viverra egestas massa magnis ut neque in.

Elit magnis

Nisl volutpat condimentum tellus viverra dis massa iaculis ac eu elementum. Ut elit convallis vis sagittis natoque ridiculus. Quam cep elit purus.